What the heck is “junk silver” ?

Junk silver refers to silver coins that have no numismatic or collectible value but are instead valued for their silver content. These coins were minted before 1965 in the United States and typically contain 90% silver, with the remaining 10% made up of copper.

In today’s precious metals market, junk silver holds value primarily due to its silver content. Silver as simply a precious metal is used in various industrial applications and is sought after for investment purposes, especially when inflation begins to rise. While the value of silver can fluctuate based on market conditions, it has historically maintained its worth over the long term.

The appeal of junk silver lies in its accessibility and affordability compared to other forms of silver investment. Junk silver coins are typically sold in bags containing a specific face value, such as $1 or up to $500, and their value is determined by their silver weight rather than their condition or rarity. This makes them a convenient way for buyers to acquire silver in smaller denominations.

Junk silver coins are also recognized as legal tender in the United States, which means they can be used in transactions at their face value. However, due to their silver content, their intrinsic value is higher than their face value, making them more valuable as bullion rather than as currency.

When considering the value of junk silver, it’s important to keep in mind that it can vary based on the current spot price of silver, which is the price silver is traded in the global market (changes daily). The spot price is influenced by factors such as supply and demand dynamics, economic conditions, geopolitical events, and investor sentiment.

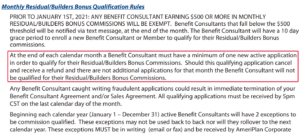

Junk silver provides an affordable and easily divisible form of silver investment, that allows individuals to own fractional amounts of silver without the higher premiums associated with numismatic or collectible coins. It offers a tangible asset with inherent value and the potential for capital appreciation over time. However, like any investment, it’s important to conduct thorough research and consider your own investment goals and risk tolerance before entering the precious metals market. For some specifics, check out the chart below:

|

Want to buy gold or have your own webshop drop-shipping gold? You’ve come to the right place.