Investment Options for Your Income Snowball

When building a Tardus Income Snowball (what some call cashflow stacking), one wonders what fast burning fuel options and slow-burning fuel options to consider.

The Tardus Official facebook group had a wealth of options on this prior to it being deleted without notice. It also had good feedback on which places didnt work so well for members and why. sigh.

The Income Snowball investment requirements are a tough nut to crack

The reason why is that you are getting interest and principle back 1 month after you put the capital in the investment. If I could wait 3 years and compound the investment capital at 4 or 5% interest, then it would be easier to generate the types of returns needed for reasonable but safe results.

So let’s work through some investment options that I am either involved in or would consider being involved in.

Permanent life insurance

In my upcoming book, I make it clear why permanent life insurance is excellent not just for getting steady “returns” but also for being your lending source. for more details on structuring such a policy, contact me.

Also Mike Kwong has written “DIBS on your money” on the same topic.

Legacy Integrated

I used Legacy Integrated for my cashflow stacking while in Tardus. For 2 years, I had no problem using their models for generating fast-burning fuel. Monthly payments automatic and without a hitch. The two models they currently offer are conversative and tactical. Tactical offers 8% amortized over 2 or 3 years and Conservative offers 5% amortized over 3 years.

All you have to do with get the right account setup at Schwab and then fill out their form get capital drafted. Your payments come in on the first of every month like clockwork.

The one problem I had in Legacy was when I chose an investment that did not fit my risk profile. It was an aggressive investment offering a higher ROI. I exited the investment early.

Legacy services Tardus and non-Tardus clients for fast-burning-fuel and also slow-burning-fuel. I cant comment on their SBF options because I am in the fast-burning fuel stage.

Paperstac

Paperstac has a wealth of mortgage note investment options offering nice double-digit returns. And if the person defaults on the note, then you can seize the property. Just make sure you buy notes in non-judicial foreclosure states, so the foreclosure is automatic. In a judicial case you have to go to court and it might take time.

Other Mortgage Note Companies

- I’m going to a meetup here in South Florida to learn about CEO fund, which also provides monthly passive income from mortgage notes. Even though the page says for accredited investors, the meetup says non-accredited are welcome as well.

the investment capital before returning it – it has to be returned the next month!

Cryptocurrency

Cryptocurrency is still a foreign beast to many… but as more and more things move onto the blockchain, the opportunities for daily and monthly pay will continue to grow. Here I list what I know about and have used

Liquidity pools

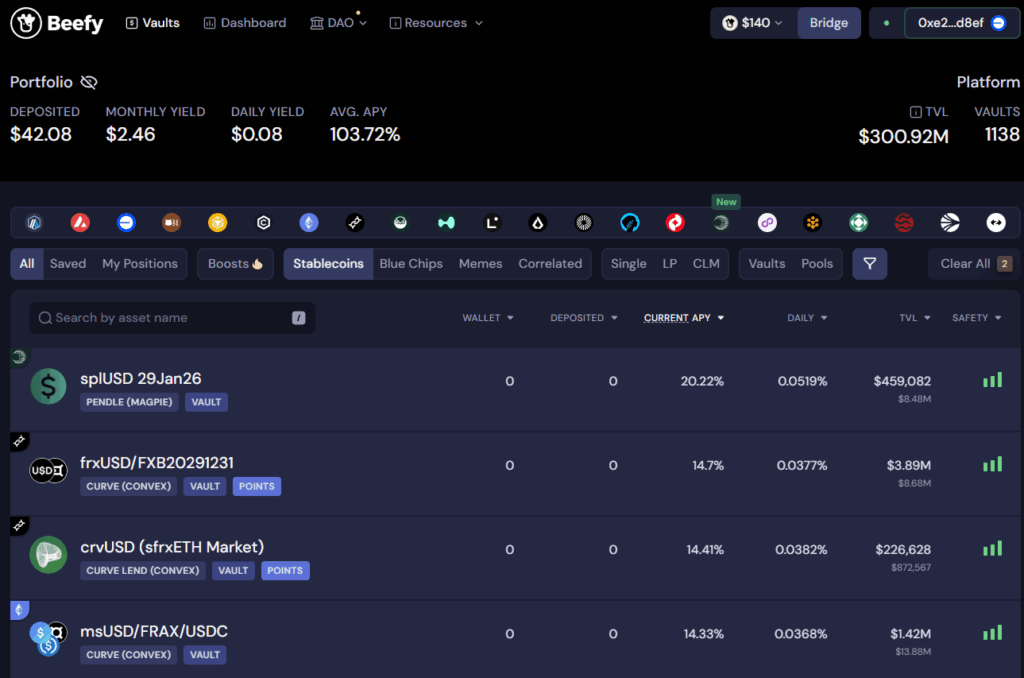

the exchange of currency requires a person holding the currency to exchange with you. They do so for a fee. Providing capital to others in exchange for a fee is known as being a liquidity provider. When providing liquidity you can assist the conversion of a stable coin (e.g. USDT) to another stable coin (e.g. USDC) or you can assist with stable-volatile conversion of volatile-volatile conversion. The ROI on volatile-volatile is the highest but comes with the most risk If you visit Beefy, you can see some impressive and realistic rates of return for stable coins: