MT Options – what you need to know

I just cancelled MT options because my 10k account is now at 8k and I’m starting with Darren Winters. Darren Winters has guarantees that you will earn your fees back.. 10-fold. MT options does not.

Let me share some things with you about MT Options:

First their FAQ is wrong:

In their FAQ they state

How much money do I need to start?

Most firms allow individuals to open accounts with as little as $500. We recommend that you start with $2500-$5,000. This will allow you to get into more opportunities. In order to experience the full strength of our system, you need to participate in all of the plays.

But if you put $5000, you will be allocating some/all of your funds because they hold as many as 8 positions at a time and one contract of some of these can cost $600.

You should only have about 25% of your account in positions for sound risk management. If you dont have 20k to play with, dont play.

Percentage returns mean nothing

Their performance reports shows percentage returns. But what it doesnt show is how well they do on cheaper stocks and how poor performance on one expensive stock (e.g. TSLA) will wipe out 90 wins of small stocks. Here are some reports directly from global autotrading (which they broke relations with – but how else are you supposed to trade all their picks automatically?!)

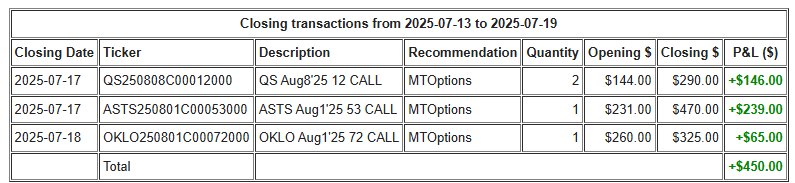

For example, here is a good week:

but notice that 1 contract of that cheap stock produced $65 in profit.

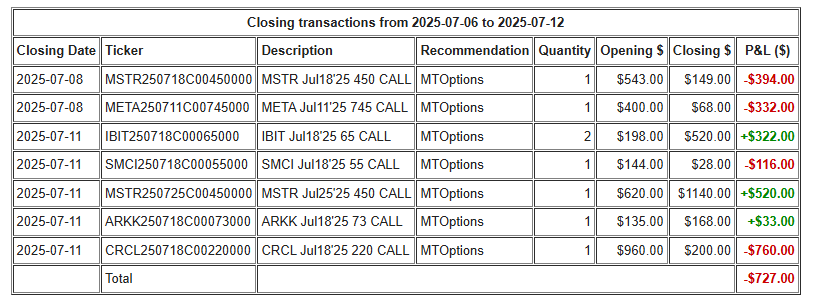

now notice the CRCL loss here:

it is 10 times the loss of the OKLO profit above… so when their performance report shows percent returns for a year, do not think your account will have that percent returns. This is not like forex where a 100k and 10k account both would have the same percent- return … we are dealing with buying contracts so the amount of each stock you buy will vary unlike in forex where you simply change lot sizes based on account size.

They trade simple calls and puts for 100% gain or 100% loss

Now that I’ve learned a bit about options from my great current teacher, one would realize that if you are bullish or bearish on a stock, there are ways to capitalize on sideways and weakly bullish trends via call debit spreads… in other words, while MT options is hoping for the big win on a simple call, a more sophisticated approach would be using a call debit spread.

They dont even have autotrading agreement anymore.

They do have other services

Maybe monster trades or their other services would be more to your liking? None of their services have the written guiarantee that Darren Winters has.