Trade Algo: the good, the bad, the indifferent

4 min read

I am both a shareholder and signal receiver with Trade Algo. what I mean is, I own shares in Trade Algo that I purchased through StartEngine and as I write this, I also have a 1-year membership in their program where they offer signals for you to trade. this review will focus on the signals you get from Trade Algo and I will mention the names of each trader. Please understand that this is a subjective review and since they offer a 6-month unconditional money-back guarantee, you have nothing to lose in giving it a whirl.

The killer app: dark pool monitoring

Most of the US stock market is traded in 64 “dark pools” where huge trades ranging from 100k to 1 or 2 BILLION (no typo) are happening with no impact on retail platforms whatsoever. Trade Algo has spent the money to access ALL the dark pools.

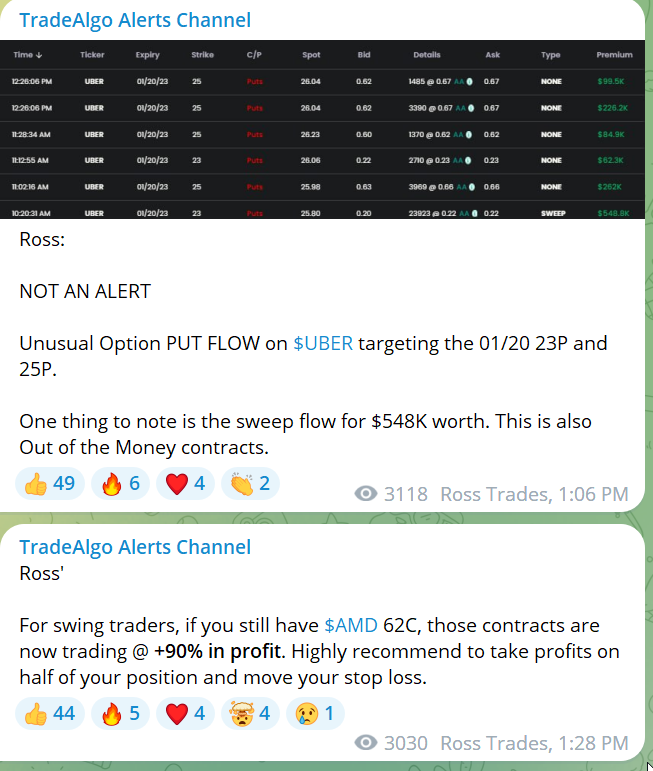

The good: Ross’s swing signals

Ross operates live audio/video trading room from 9am to 2:30pm where he articulates his thoughts and also places live signals in the Telegram room. I am impressed with his analysis and the signals are quite good so far. And because they are swing trades, i dont feel any urgency about getting the trade placed in a timely fashion.

The most difficult thing about these signals is entering the stop loss and take profit. And that is just the nature of options – you have to create OCO (one cancels the other) orders where hitting the profit target cancels the stop loss order and vice versa. It’s much more tedious than entering trades in forex where you simply have TP and SL and part of the concept of a trade.

and that’s where we get to the most serious issue with ALL aspects of Trade Algo signals – you have to manually enter them. In this day and age of automated trade copying for Options signals at platforms like Autoshares or Global-Autotrading, there is no reason to have people dropping everything they are doing to enter a trade because of a Telegram alert. In fact, I missed the juicy AMD trade above because I had work issues to deal with when the Telegram signal came through. Had they offered autotrading of signals, then that would not be a problem.

The bad: let me clear my throat

Deceptive spam

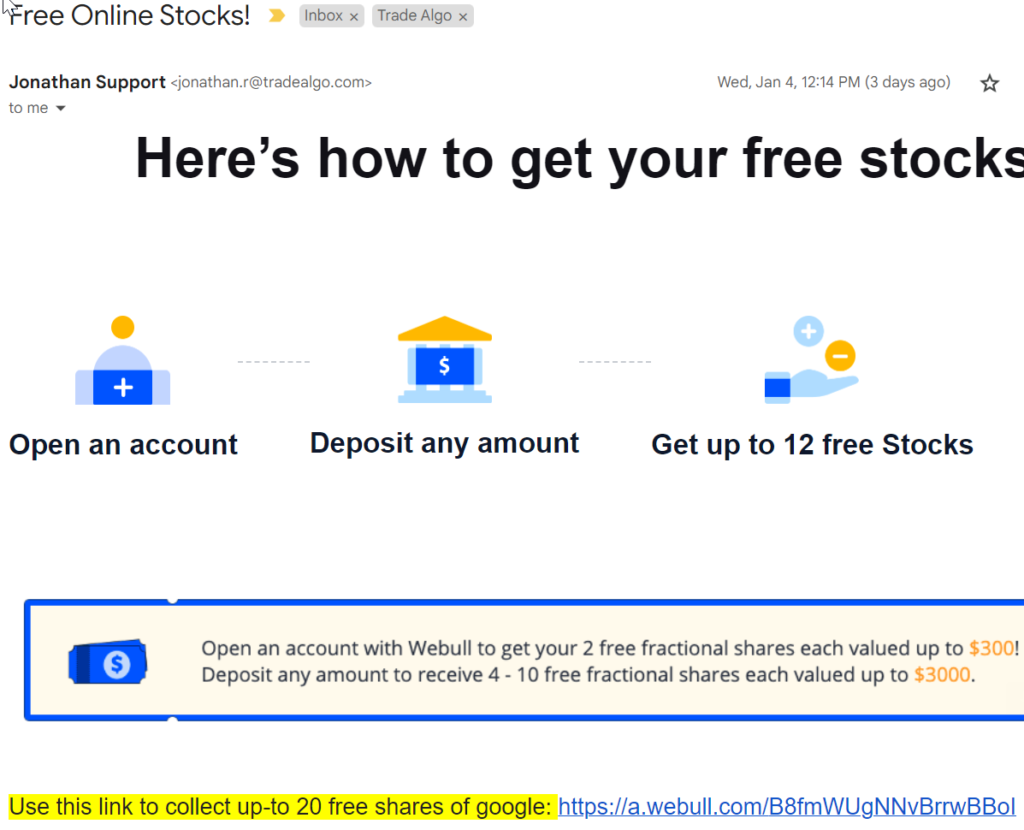

Not long after paying my annual membership fee of $1,875 I received this email:

There’s only one problem. The rules clearly state that they randomly select any of a number of stocks.

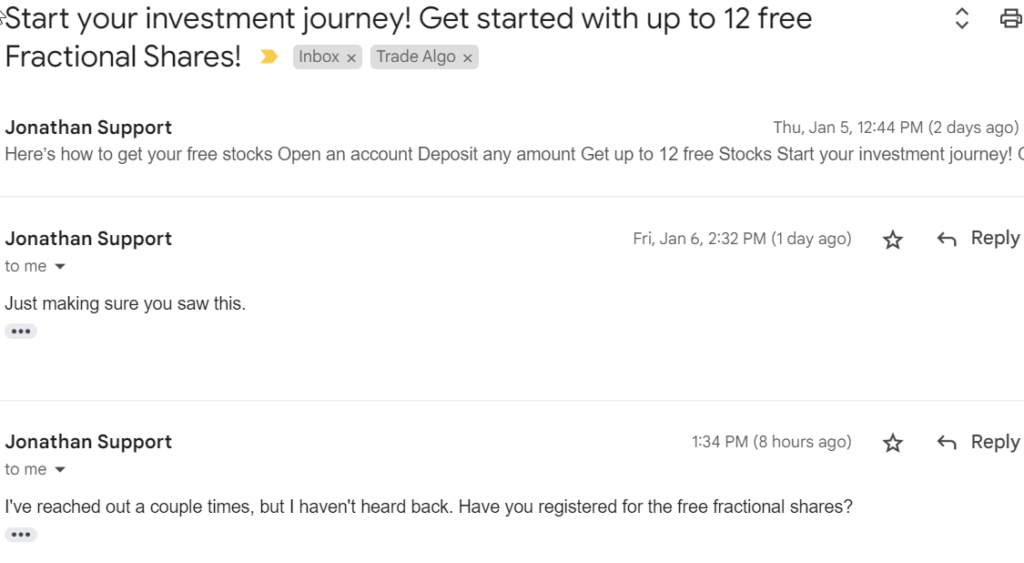

Plain ol’ badgering me so they can slurp down referral fees

And it doesnt stop. I have 5 emails from them trying to get me to use a particular broker.

The Brian Mitchell quote-unquote signals

On the marketing webinars where they attempt to recruit new subscribers, Brian Mitchell shows his earnings… but do you know how he trades?

- He finds a trade

- pastes in it a text chat room

- sometimes within 3 minutes he’s out of the trade with a profit.

Well, that’s good for him, but what about those of us who are still entering the trade, double checking what we did and not getting the same/similar entry because of our delay.

THAT’S WHY TRADE ALGO IS A WASTE OF TIME UNTIL

- THEY HAVE AUTO TRADED SIGNALS

- THEY HAVE A YEAR TRACK RECORD SHOWING THE RESULTS OF THOSE SIGNALS

yearly memberships instead of monthly

I’m used to paying for monthly memberships that I can cancel at anytime. Trade Algo wants to suck 4 figures of out of you for an annual membership…. not my style. And

delaying returning my money

Trade Algo did finally honor their money-back guarantee but not without a bunch of salespeople calling, offering lower rates and trying to overcome my objections. And no, they didnt return it when they promised, TWICE, forcing me to file a dispute at which time they finally returned the capital.

Overall

not my cup of tea. I’m into deposit-profit-withdraw not deposit-sit around in a chatroom and frantically try to enter signals as soon as they post them and then listen to a person make excuses about why the trades failed.

not cool to delay the return of my funds… TWICE.