Newsletter 2

5 min readI dont send out newsletters often but once I came across certain products, I had to start putting together this newsletter. The products are listed in order of how solid they are and also how much capital is needed to get involved.

Tardus Wealth Strategies

The objective of Tardus Wealth strategies is to create a passive income snowball. They took a look at your entire financial landscape and setup a 5-20 year plan to take you from where you are to being debt free and paying all living expenses from passive income not active income.

I really liked the person who interviewed me. He got started because his Mom had worked 2-3 jobs all her life and then he saw it working for her to become financially free. So not only did he get going as a client, but he is now also a financial coach. I suggest you visit their website and take their mini-course and then contact them for a free strategy session where they will look over what comes in versus what goes out and how much of what goes out is debt versus living expenses. Then two weeks later after a team of people have thoroughly analyzed your financial landscape, they will carve out a plan to make you financially free.

The company is run by a former attorney who certainly had her downs before getting on top of the game of passive residual income. As you go through the course you will see what I mean.

I learned a lot real fast in my interaction with them:

- I learned a lot in the mini-course

- I learned a lot about the monthly things that are being sucked out of my bank account

- I learned that I have no plan to retire and the standard approach to retirement is completely out of my reach.

This tish has to stop:

Having $800 to my name on average and many times have $0.00 of cashflow at the end of each month is no way to live your life. I’m very lucky I found Tardus and once you check them out and take the mini-course, I feel certain you will feel the same.

Rent to Retirement

Rent to Retirement is an exciting turnkey program that I ran across while surfing Bigger Pockets (the world’s hub for real estate investing). These are rental homes where all you do is pay 25% down and they do everything else. The ROI is relatively low – 10-12% per year. But for those with 30-50k just sitting somewhere it may be worth looking at.

They care about their clients. After listening to me, they did not want me to put all my savings into a single down payment – they simply didnt like the sound of it. They build their business by offering a quality service to completely qualified clients. And I simply didnt cut the mustard.

Corporate Credit a-go-go

A quick update on my year long subscription for corporate credit card funding through Fund and Grow:

About 4 months ago I got 2 corp credit cards with 52k of available balance.

Today, Feb 14 2023, I did my second batch of funding and got:

- 10k E*ncard

- 9k B*a card

- 25k T*t card

So I pulled in 44k of funding my second round…. they applied at 5 places and I got funded at 3. The previous round they applied at 4 places

UPDATE, UPDATE!

Just when I thought the pork was done flying, they got me at 16k card from a certain bank that I was certain I would never get approved at again… so make that 60k of funding in a single round… bay bay!!!!

Making Personal Debt Disappear

I wanted to buy a house but my debt-to-income ratio showed a lot of loans on my personal credit profile… I make 10k/month but all the loans on my personal side made by DTI too high. So what did I do? I used my favorite funding source for corporate credit cards and once I got the cards I simply gave them the accounts of the personal loans… and they transferred the debt to my corporate side… I didnt even have to make use of my resource to liquidate credit cards to cash … it was all digital, bank to bank baybay!!!

Ooops!

I made one mistake. I did not wipe off my hard inquiries from getting the corporate credit and so after I got the home approval they wanted me to tell them about the hard inqs… oh well, lesson learned. Next time I will use my preferred source for rapid hard inquiry removal before getting pre-approved for a home loan.

My Forex Journey

Autotrading with Sarowar Jahan

I’ve been following this professional forex trader for awhile. After a brief chat on Telegram, I slapped a grand into his higher-yielding auto-traded signal at Signalstart. I’ve already made 30% profit….

UPDATE: account tanked! Sayonara to 1 grand!!!

Getting a $100,000 funded account for just a small fee

I dont know if you’ve heard of FTMO and similar sites. What they do is have you pay a small fee of like $500 and give you a small account to trade. If you do well, you can move up to trading $100,000 of money for them.

A friend of mine of Telegram got his 100k account and he can show you how to get yours. Chat me up on Telegram for details.

I told him I would check in in 3-6 months and see how it is going.

Federal Income Tax – new video

I updated my flagship post on income tax and moved Pete Hendrickson up to number 3 because of the new video he produced.

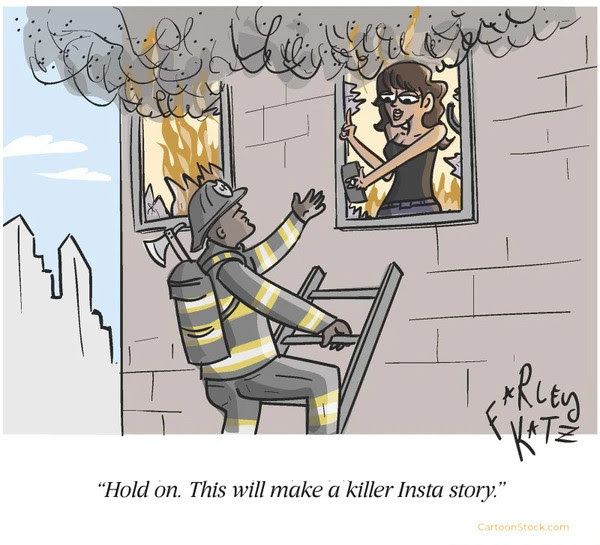

And we always have to close with some humor:

If that didn’t make you laugh, perhaps this will.