United Financial Freedom debt/mortgage reduction software review

3 min readSUMMARY

- Product: money max account software by United Financial Freedom (formerly Worth Unlimited)

- Service: debt/mortgage reduction

- Cost $3200

- Referral Program: yes: generous and lucrative

- Rating: 3/10

- Recommended? Depends on your needs and your appetite for fraudulent sales tactics

United Financial Freedom, or something like it, belongs in everyone’s toolset once you get past the age of 15.

I am now 51 and and I’ve spent 36 years without a clear idea of how much was coming in, how much was going out and how much of an ass-reaming I was getting from the pretender-lenders.

I basically have been a zombie, tossing money out of the window on a daily, weekly, monthly, yearly and decadesly (is that a word?) long basis.

And if it werent for the wakeup call from United Financial Freedom, I might’ve been another casualty of debt which was creeping up to my neck and about to drown me – REALLY.

Once I plugged in my numbers and accounts, I was shocked.

First of all, it new how much money I had every month from my bi-weekly salary.

I thought that was a simple calculation but since some months have 5 weeks and others 4, you want to live your life on the average amount you will be getting and budgeting with rollover to make sure you can cover yourself on the 4-week months and not overspend just because you got 3 pay checks in a month.

Next, it does a very good job of telling you what to do when.

OK, it it’s so damned good, then why did you rate it a 7? One word: lack-of-automation. This is one word, isn’t it???!

Since I like long stories, you get to listen. I got the software and got some excellent training from the recruiters who help you earn a good income from building a team. But then all the glitter wore off and I asked myself: arent there are other debt/mortage reduction programs out there?

TLDR: there are plenty of good credit card reduction programs, but much fewer mortgage reduction programs

So I started googling my posterior maximus off and tried undebt.it, unbury.me and Quicken. I looked at YNAB and when it came down to it:

Quicken was the product for me, because of AUTOMATION:

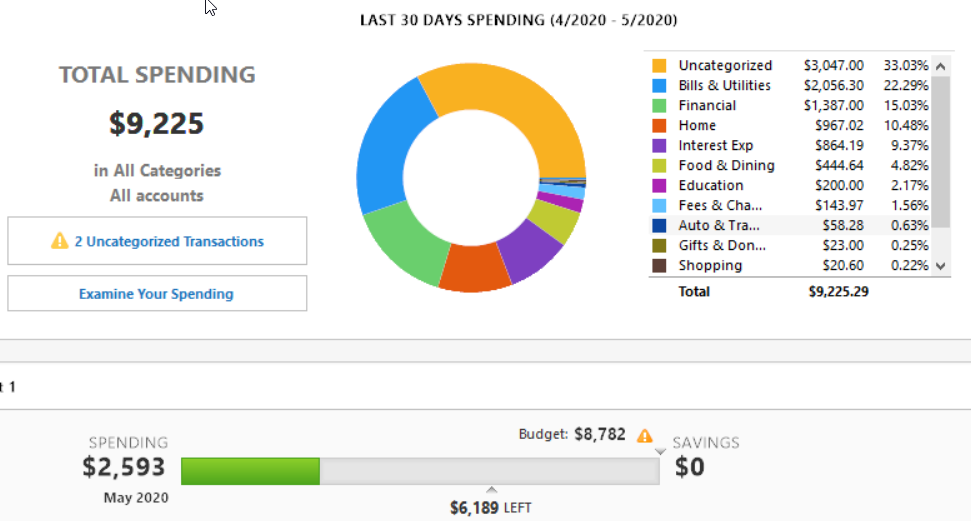

automatically downloading everything from all my accounts, so that I was not imagining how much I owed in each category. Instead Quicken was relentless in showing EVERY single thing I was doing in EVERY single account, whether I liked it or not. also automatically categorizing all the hundreds of transactions I have and doing a pretty good job on over 90% of them.

And since I dont have a mortgage, I have to go with the automation of Quicken.

One day, when I have a 7 bedroom million dollar mansion, I may go with UFF

but then again, one of the programmers at UFF made himself available and the software will be available for $200/mo from an insurance IMO that I know of. Get in touch to know more.