RAD Diversified Review

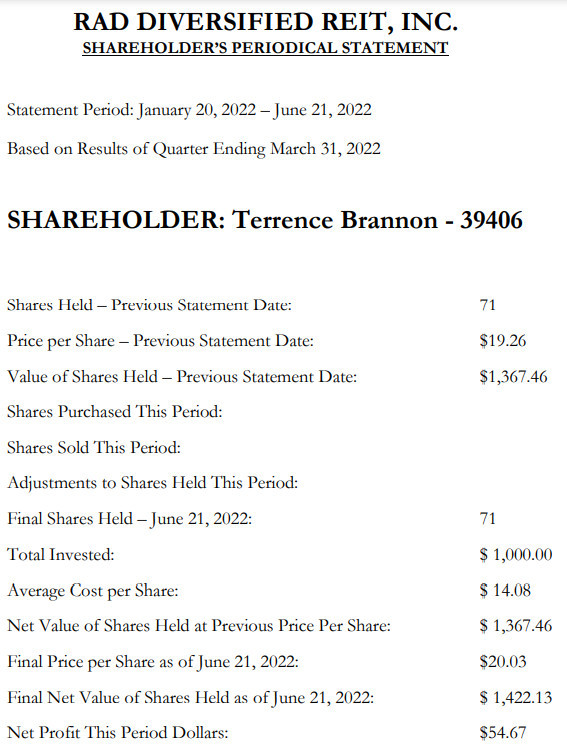

For those who like it short and sweet, here ya go: i joined RAD Diversified in June 2021 and now one year later my $1,000 investment is worth $1,400.

There is a lot more to RAD Diversified than that, so if you have the interest and time, you are welcome to read on!

It Works

I saw a facebook ad somewhere and it caught my attention. I opted in to a form and had a call with their salesman. He sent me some info and followed up the next day. After a quick rehash of the material, I whipped out my plastic and bought $1,000 worth of shares. These shares are now worth about $1,400. A nice 40% increase in value. The only issue I have is that you never want to sell your shares because you know they will be worth more later. I think that why the next logical step with them is Diamond 5, where you learn to acquire and flip/rent properties for ongoing profits. More on that later.

It’s Real

Dutch (CEO) is as real as they get an real estate is the most real investment there is (besides perhaps gold). I really don’t get their YouTube advertising angle though. Person after person is saying “I’ve never lost money with RAD diversified”… ok, meanwhile, other people are saying “let me step out of my Lambhorgini and walk inside to my computer and show you some screenshots of how much money I’ve made… after my hot blonde wife fixes me a latte”… I mean we are interested in RAD to thrive not just to not lose money. Of course, it makes sense that you wouldn’t lose money with RAD: we are dealing with real estate and Dutch was savvy enough to make it through the years of 2020 and 2021 turning a solid profit.

They Always Get Back to Me

Thought it may take awhile, they are committed to getting back to you and they’ve never failed to do so. Not only that, but Dutch fields questions on their regular Zoom meetings.

It’s Hands Off

A marketing mastermind once told me: “You make more money with your brain than with your hands.” This is something i agree with. Anytime I can simply drop cash on something and come out in profit, I’m on it. Anytime I have to roll up my sleeves, put on knee pads or otherwise put effort into collecting dollars, forget it.

To call it “diversified” is accurate – many investment vehicles exist

An article by alts gives a thorough executive overview of the investment vehicles available within RAD. I speak of the programs that I know about by direct conversation with RAD. I am what they call a non-accredited investor. Just an average dude who had some bread laying around and slapped it in their REIT. Another program available to me is Diamond 5. This is where you learn the nuts and bots of locating and acquiring profitable deals. It does involve work but it eventually means you dont have to work for someone else. You will have to contact RAD for more details about getting started and about their accredited investor options.

I’m Glad i found it

i’m really happy i took the leap of faith. i’ve always liked real estate and Dutch is a self-proclaimed real estate dog. He eats, sleeps, and breathes real estate. You can feel it on his live webinars. That’s the type of person I want to be around.

I have a bit of trouble understanding what the 50k option (Diamond 5) would do for me

The exact details of the Diamond 5 program – who is in it, what they are doing on a daily basis, what you learn and how much ROI on the 50k they have seen. And of course, where does the 50k go?

For most people, the main problem with real estate is getting funding – lenders want 20% of the property value up front. With my new lending sources, that amount of capital becomes reasonable.

But again, some good answers to some commonsense questions on Diamond 5 are in order. Maybe I will hop on the next monthly call and ask.

Conclusion

There are 2 ways to generate passive income: having a network of people work for you and having capital working for you. RAD diversified is an appealing vehicle to put capital to work for you. They took the pains to make their REIT SEC-conformant. They acquired properties to yield returns that are far better than I’ve seen reported from Fundrise or other similar services. And they work hard on transparency by having a regular meeting.

I would say that RAD is recommended for the person that wants to grow a little capital and perhaps also grow their knowledge of real estate investing.

I think this website looks awesome and really professional and well put together. However, as a person that is not as familiar with real estate, I found the post confusing. Would it be possible to simplify this information for someone that may want to know more and be interested but doesn’t know “the lingo?” The structure of the website itself is great but I was a little lost. A general explanation of what RAD Diversified to start off would have possibly given me little more clarity. This way, you could get more readers that may unfamiliar with this topic but are interested in learning more.

You’re right. I wrote this post primarily for people who had at least heard of RAD Diversified in the past. In terms of “the lingo” I cannot offer clarification without knowing exactly what confused you. As far as what RAD Diversified is, I will offer a non-technical description of them. RAD Diversified wants others to experience the success in real estate investing that they have. The CEO, Dutch Mendenhall, does all sorts of real estate investment. He does “buy-and-hold”, which is where you buy a property and then rent it out. He also does ‘fix-and-flip’ which is where you buy a property in non-livable condition for a huge discount and then fix it up and sell it for a quick profit, usually well within 90 days of fixing it up.

Is passive income investment profits realize after inial ? What is recomended time selling stocks before at Rad.

Hi Ryan,

Re: “Is passive income investment profits realize after inial ?” – there are 2 main ways to participate in RADD, Inner Circle and share purchases. I do share puchases because it only costs $1,000 to get involved whereas Inner circle costs 25k to 50k and after that you still have to pay money for investing in each property. So “passive earnings” regarding shares is simple: you buy shares in RADD and you hope they go up in price, at which point you sell them. And I do believe I also get a small dividend payment of some sort, but I dont really login and check every quarter to see.

Ryan, re: “What is recomended time selling stocks before at Rad” -> I would say that depends on your appetite for risk and your goals. I would highly recommend attending their live calls to ask questions like this, just in case there is some new news coming out such a stock split or something.

I would like to invest into RAD diversified but does the interest gained on ones investment out weigh the risk?

I’m in no position to give you investment advice. I imagine it is a personal decision about that…. I think the best question is: where do you see yourself in the next 10-20 years? Do you have enough saved for retirement? If not, what is your overall game plan for that?

In other words, RAD may or may not fit into your short or long term goals based on who is coaching you towards what goals you are looking for: they might see it as a growth vehicle, speculation vehicle, etc.

Can we get an updated review from April of 2024?

is it difficult to withdrawal money or better question do you feel as confident still in your investment?

hi Eric, I havent really paid attention to RADD or my investment there. i guess if i got pinged a few more times, I might go ahead and withdraw all my funds and put more into the investments vetted by my preferred program.

So I would not judge RADD one way or the other based on me. I’ve just been so busy with other things that I have not been logging into the webinars they invite me to, etc.

As far as I’m concerned, the framework for building cashflow using investments is more important than choosing any particular investment itself. That’s what i learned from being with my flagship program for over a year now – https://mymoneymagick.com/my-flagship-program/

Here you go. Update from last night – https://www.youtube.com/watch?v=Y0IS8NcxUaM